How IC-DISCs Work

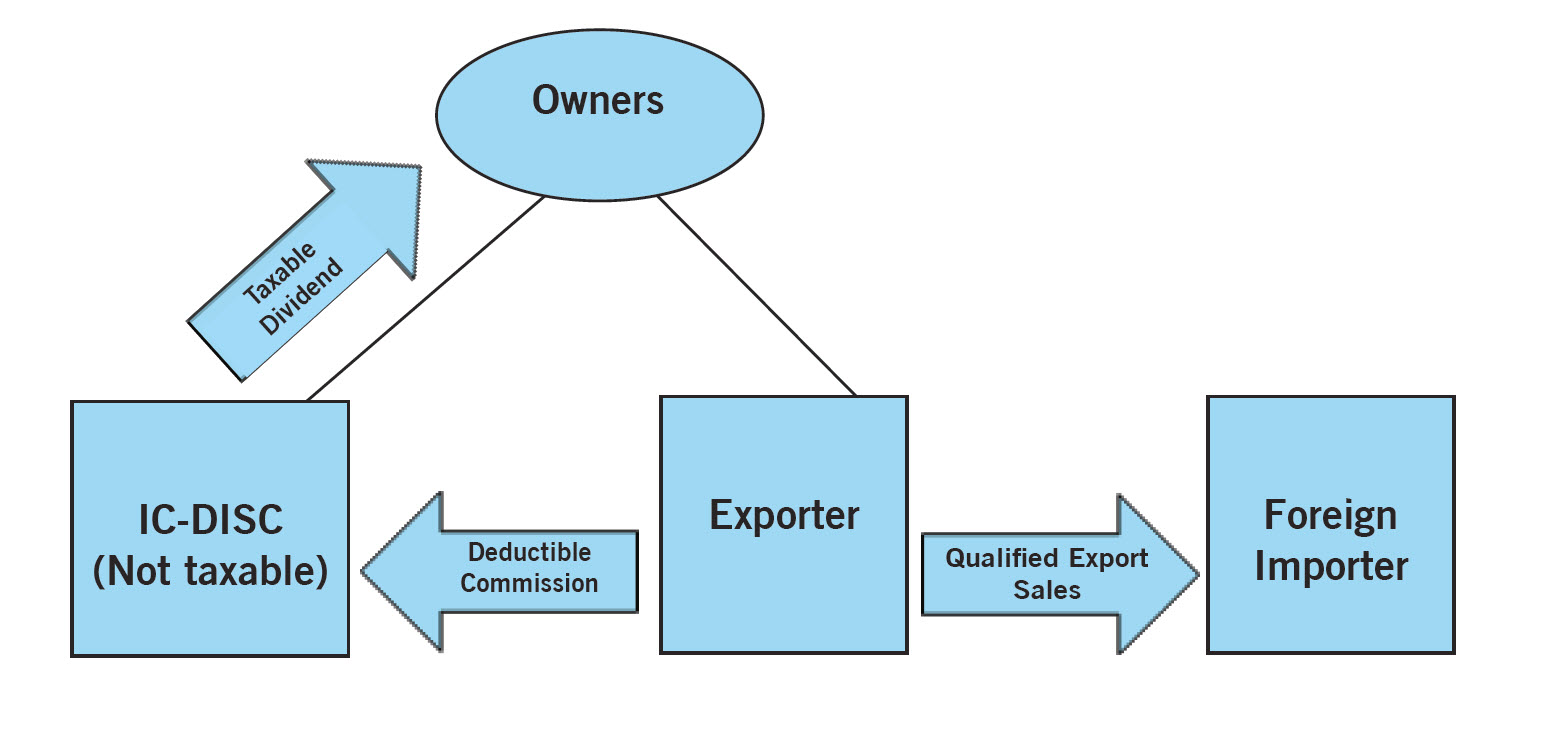

Exporters and their owners can reduce federal income tax on an amount of export profits by using an Interest Charge Domestic International Sales Corporations (IC-DISC) structure.

An IC-DISC is a corporation which serves as a sales commission agent for the exporter. The exporter pays a sales commission to the IC-DISC and is entitled to a deduction for the commission paid. Because the IC-DISC is tax-exempt for federal income tax purposes, the IC-DISC does not pay federal income tax on the commission income. The shareholders of the IC-DISC instead pay federal income tax at rates applicable to dividends (currently, 23.8% for high income individuals) when the IC-DISC pays a dividend (or is deemed, under the IC-DISC rules, to pay a dividend).

Importantly, the IC-DISC need not actually conduct any sales or other business activities to earn its commissions. Thus, the IC-DISC does not need office space, employees or tangible assets.

Common IC-DISC Structure

Setting Up the IC-DISC

There are several statutory requirements for an IC-DISC. An IC-DISC must be a corporation formed under the laws of any U.S. state.1 An IC-DISC can have only one class of stock. The IC-DISC stock is generally owned by the shareholders of the exporter.2 In some cases, depending on the tax status of the exporter and state tax treatment of the IC-DISC, the exporter entity may directly own the IC-DISC stock.3 The IC-DISC must maintain a capitalization of at least $2,500 on each day of the tax year.

The IC-DISC is required to obtain a federal identification number and may be required to register in states in which it has a nexus for state income tax purposes.4 Finally, it is important that the IC-DISC be respected as a separate legal entity. It must therefore maintain corporate formalities, including separate books, records and its own bank account.

Electing IC-DISC Treatment

An election is required for IC-DISC status. Form 4876-A, Election to be Treated as a DISC, must be filed with the Internal Revenue Service within 90 days of the beginning of the IC-DISC’s taxable year for the election to apply to such year. The election must be signed by all shareholders of the IC-DISC as of the effective date of the election. Once made, the election is effective for all subsequent years until it is revoked by the corporation.

Entering into a Commission Agreement

The exporter and the IC-DISC must enter into a commission agreement. This agreement will set forth the services that are to be performed or subcontracted by the IC-DISC in connection with the sale of export property. The permitted commission rate is set by statute, and is generally5 limited to the greater of:

- 4% of the exporter’s qualified export receipts, subject to certain limitations; or

- 50% of the exporter’s taxable income attributable to qualified export receipts.

Examples of Potential Tax Savings

Assume an exporter has $3,000,000 of export profits on $9,000,000 of qualified export receipts. The commission can be the greater of $1,500,000 (50% x $3,000,000) or $360,000 (4% x $9,000,000).

Example 1: C Corporation Exporter

Without an IC-DISC structure, a C corporation exporter would pay $1,050,000 ($3,000,000 x 35%) in income tax (ignoring state income taxes), leaving $1,950,000 in after-tax income. Upon distribution of the after-tax income of $1,950,000 to the C corporation shareholders as a dividend, the shareholders would owe an additional $464,100 in taxes. The net after-tax proceeds to the shareholders of the C corporation exporter would be $1,485,900.

With an IC-DISC structure, the C corporation has a commission deduction of $1,500,000 and its total tax liability is reduced to $525,000 ($1,500,000 x 35%), leaving $975,000 (after commission and taxes) in the C corporation, and $1,500,000 in the IC-DISC. An aggregate of $2,475,000 is available for distribution to C corporation and IC-DISC shareholders. The shareholders would pay $589,050 ($2,475,000 x 23.8%) in taxes. The net after tax proceeds to the shareholders of the C corporation exporter that has set up an IC-DISC is $1,885,950 ($2,475,000 – $589,050).

In this example, the potential savings for the C corporation exporter and its owners gained by using an IC-DISC structure is $400,050.

Example 2: S Corporation/LLC Exporter

If the exporter is an S corporation or a tax partnership (such as an LLC), its owners report $1,500,000 less in income on their individual income tax returns, saving $594,000 ($1,500,000 x 39.6%), again ignoring state income taxes. The $1,500,000 paid to the IC-DISC is taxed to the IC-DISC’s owners (when paid or deemed paid) as a qualified dividend at the 23.8% rate, resulting in tax of $357,000 ($1,500,000 x 23.8 %).

The potential tax savings for an S corporation, or an LLC exporter and its owners using an IC-DISC structure, is approximately $237,000 ($594,000 less $357,000).

Maintaining IC-DISC Status

Once an IC-DISC is formed, annual requirements must also be met, including:

- Qualified Export Assets — At least 95 percent of the IC-DISC’s assets must be qualified export assets. Qualified export assets include: export property, working capital (only the amount necessary for required working capital), commissions receivable, stocks or securities of a related foreign export corporations, and producers’ loans. Importantly, “export property” is property that is manufactured, produced, grown, or extracted in the United States for use or consumption outside the United States. Up to 50% of the fair market value of the export property can be attributable to foreign content.

- Qualified Export Receipts — At least 95 percent of the IC-DISC’s gross receipts must be qualified export receipts. Qualified export receipts include, among other categories, gross receipts from the sale or lease of export property and from services related to such sale or lease.

- Payment of Commission — A reasonable estimate of the commission must be paid within 60 days of the exporter’s tax year-end.

- Annual Filings — An IC-DISC is required to prepare financial statements (an income statement and a balance sheet) annually, file its U.S. income tax return (Form 1120-IC-DISC) and, if applicable, its state income tax return.

- Books and Records — The IC-DISC must maintain a separate set of books and records.

- IC-DISC Distributions — The IC-DISC generally must distribute cash to its shareholders in the form of a dividend on a periodic basis. If the IC-DISC chooses not to pay a dividend to its shareholders, an interest charge based upon T-Bill rates applies to the deferred tax. Note: There are deemed distribution rules related to qualified export receipts that exceed $10,000,000. These rules can result in shareholders bearing tax on the IC-DISC’s earnings without any actual distribution. (To avoid a “deemed dividend” the IC-DISC may also, subject to some restrictions, lend the cash back to the exporter, use the cash to make investments, or some combination of these options.

| Practice tip: The IC-DISC shareholders may want to consider a shareholder agreement with the IC-DISC providing that the IC-DISC will distribute annually at least enough cash to fund the income tax liabilities incurred by the shareholders on IC-DISC “deemed dividends”. |

Selected State Tax Treatment of IC-DISC Commissions6

| State | IC-DISC Treatment |

| Connecticut | Tax-Exempt |

| Delaware | Tax-Exempt |

| Maine | Taxable |

| Massachusetts | Taxable |

| New Hampshire | Taxable |

| New York | Tax-Exempt |

| Rhode Island | Tax-Exempt |

| Utah | Generally passed-through to its owners |

| Vermont | Tax-Exempt |

For more information on this topic please contact Chip Wry.

Footnotes:

1. In many cases, Delaware will be used as the state of incorporation because of general familiarity with Delaware corporate laws and because Delaware follows the federal tax treatment of IC-DISCs.

2. Other owners, such as employees and family members, are also possible.

3. Careful analysis of state tax treatment of the IC-DISC structuring is necessary, however. In Massachusetts, for example, this structure would have the effect of subjecting the IC-DISC commissions to tax.

4. Not all states (including Massachusetts) follow Federal IC-DISC tax treatment. See the table “Selected State Tax Treatment of IC-DISC Commissions” at the end of this article

5. If the IC-DISC takes title to property and sells it through its own employees and operations, the permitted commission may be the actual commission earned by the IC-DISC.

6. The above chart is intended as a broad survey only. Specific rules of each state should be analyzed further.