Introduction

The structures for granting equity incentives to employees and other service providers of corporations are tried and true. The income tax consequences to a grantee service provider upon his or her receipt of restricted stock and stock options and to the issuing corporations are well-settled. Over the last 25 years, however, as limited liability companies taxed as partnerships1 have become a more popular vehicle for operating businesses, LLC managers have sought to create equity incentives for their employees and other service providers with the goal of achieving, to the extent possible, tax consequences similar to those achieved by corporate equity incentives – deferral of the obligation to pay a purchase price, deferral of tax liability, and maximization of income taxable as capital gains on an exit or later sale.

LLCs can issue 2 types of equity interests, “capital interests” and “profits interests.” Capital interests have essentially the same tax treatment upon grant to the grantee as the issuance of stock of a corporation. Profits interests entitle the grantee to a share of only future (rather than existing) income and appreciation of the LLC, and are a popular and tax-efficient way to get equity into the hands of LLC employees and service providers without triggering current tax to them. There is no equivalent to the profits interest in the corporate context. Nonqualified options (but not “incentive stock options” which may only be granted by corporations) are technically available in the LLC context as well, but the current tax rules surrounding the issuance of LLC options are unsettled. Also like a corporation, an LLC may issue contractual rights to participate in bonus compensation arrangements which may pay out based on the value or appreciation in LLC equity.

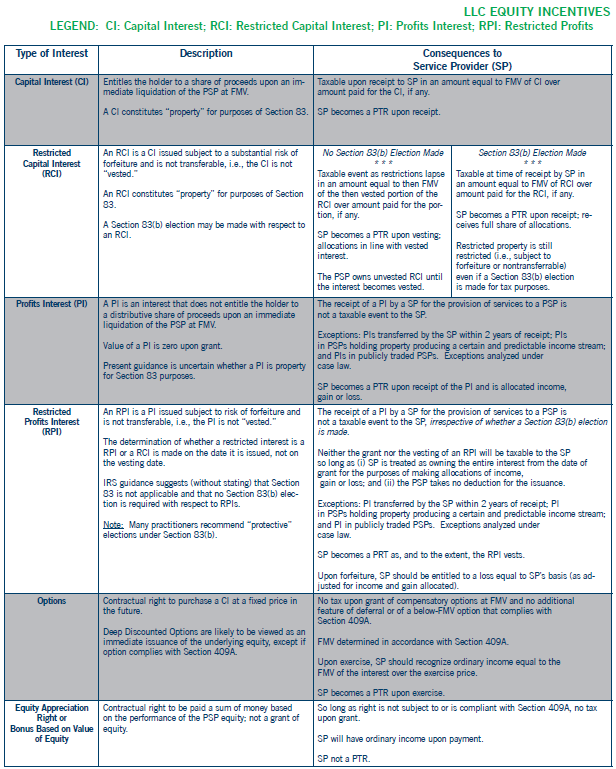

The discussion and table below outline the tax impact of LLC equity and equity-based compensation structures to both the grantee and the issuing LLC (and the LLC owners on a pass-through basis).

LLC Capital Interests

A capital interest is a type of equity which entitles the holder to a slice of the existing capital and future income of the LLC. For example, the grant of a 5% capital interest in an LLC valued at $1,000,000 on the date of grant would be worth $50,000. This is akin to granting a service provider 5% of the stock of a corporation of the same value.2

As is the case with the grant of corporate stock, the tax consequences to the grantee and the issuing LLC depend on whether the capital interest is “restricted” or “substantially nonvested” upon grant and, if “restricted” or “substantially nonvested” whether or not the service provider makes an election under Section 83(b) (an “83(b) election”) of the Internal Revenue Code (the “Code”) upon the grant of the interest.3 4

Taxation of a Vested Capital Interest

Consequences to the Grantee.

A grantee who receives a vested capital interest is taxable upon receipt in an amount equal to the difference between the fair market value of the interest and the amount paid for it (if any). This difference, if any, is ordinary compensation income to the grantee. The grantee becomes a partner for tax purposes upon receipt of the vested capital interest and is no longer treated as an employee. As a result, the grantee will share in profits and losses in accordance with the economic deal among the members; receive Forms K-1; will be responsible for paying self-employment taxes rather than having the LLC withhold employment taxes; and will pay estimated income taxes rather than have income taxes withheld by the Company. Because the grantee is no longer an employee, he will not be eligible for federal unemployment benefits with respect to his service to the LLC.

Consequences to the LLC.

Under current law,5 the grant of a vested capital interest is treated, to the extent of any difference between the value of the capital interest and the amount paid for the capital interest, as a deemed taxable transfer of a proportionate share of the LLC’s property to the grantee, followed by a non-taxable contribution of the deemed transferred property back to the LLC by the grantee. The deemed transfer of assets to the grantee will trigger gain or loss (and maybe a deduction) in the LLC which will flow through to the existing LLC owners. The transfer of the vested capital interest will also generate a compensation deduction if the payment for the grantee’s services is a deductible expenditure.

Taxation of a Restricted Capital Interest

No Section 83(b) election made.

Consequences to the Grantee: If the grantee does not make a Section 83(b) election, the grantee will have taxable income as the capital interest vests in an amount equal to the difference between the then value of the vested portion of the capital interest (at the time of vesting) less the amount paid for that vested portion. The grantee becomes a partner with respect to the vested portion of the capital interest as it vests and will only receive tax allocations with respect to the vested portion.

Consequences to the LLC: If the grantee does not make a Section 83(b) election, each time a portion of the capital interest vests, the LLC will be treated as transferring a proportionate share of its property to the grantee, followed by a non-taxable contribution by the grantee of the property back to the LLC. The deemed transfer of property by the LLC will generate taxable gain or loss that will pass through to the LLC owners as it vests.6 The vesting of the capital interest will generate a compensation deduction in an amount equal to the vested interest if the payment for the grantee’s services is a deductible expenditure. The LLC will be as treated owning any unvested capital interest until it vests.

Section 83(b) election is made.

Consequences to the Grantee: If the grantee makes a timely Section 83(b) election,7 she will be treated for tax purposes as if she received a fully vested capital interest upon issuance. Note, however, that a Section 83(b) election applies only for tax purposes. For business purposes, the capital interest is still restricted, thus, is subject to forfeiture and is non-transferrable.

Consequence to the LLC: When a Section 83(b) election is made by the grantee, the LLC is treated for tax purposes as if it transferred a fully vested capital interest.

LLC Profits Interests

While an LLC capital interest entitles the holder to a share of the existing capital of the company and a share of future income, gain and loss, a profits interest does not participate in existing capital, but rather only future income, gain and loss. If properly structured, the IRS will treat the value of a profits interest upon grant as zero.8 There is no equivalent to profits interest in the corporate context, though its economics could be compared to a fair market value option.

Taxation of a Vested Profits Interest

Consequences to the Grantee: The IRS takes the position that the receipt of a vested profits interest to the grantee in consideration for services provided is not a taxable event so long as the profits interest is not transferred by the grantee within two years of receipt; the profits interest is not issued by an LLC holding property producing a certain and predictable stream of income; and it is not a publicly traded partnership. The grantee becomes a partner for tax purposes upon receipt of the profits interest and is allocated future income, gain or loss per the LLC Agreement.

Consequences to the LLC: There is no gain, loss or deduction to the LLC or the existing partners upon the grant of a vested profits interest.

Taxation of a Restricted Profits Interest

Consequences to the Grantee: In general, neither the receipt of a profits interest by the grantee for services to the LLC nor the later vesting of the profits interest (irrespective of whether a Section 83(b) election is made) is taxable to the grantee.

While a capital interest is treated as property for purposes of Section 83 of the Code, a profits interest is generally viewed as something other than property, such that, Section 83 does not apply and a Section 83(b) election is not necessary. Despite this, many practitioners recommend making a “protective” Section 83(b) election in case the profits interest is later determined by the IRS to be a capital interest.

Upon forfeiture of a profits interest the grantee will be entitled to a loss equal to his basis in the profits interest (as adjusted for income, gain and loss allocated).

Consequences to the LLC: Neither the LLC nor the existing LLC members will recognize gain, loss or deduction upon the grant and/or later vesting of a profits interest. Upon forfeiture of a profits interest, the remaining LLC members will receive allocations related to the forfeited interest.

NOTE: Holders of LLC equity interests are not treated as employees for tax purposes. This means that the grantee is not issued a Form W-2 and are not subject to withholding. Payments for services to LLC Members may be “guaranteed payments” reported on Schedule K-1 and the tax treatment of their fringe benefits is different, than that of employees.

Terms to Consider for LLC Equity Grants

- Capital v. Profits Interests. While the economic value of a capital interest is greater than that of a profits interest, because the receipt of a capital interest is taxable, but the receipt of a profits interest is not, most service providers prefer to receive a profits interest rather than pay income taxes up-front on the receipt of an illiquid capital interest.

- Voting v. Non-Voting. Current members may prefer that the interests held by service providers be non-voting.

- Restricted ownership. Generally, service provider equity is earned over time through vesting. If vesting conditions are not met, the equity will be forfeited.

- Repurchase. The LLC may want the right to repurchase any vested interests, when service terminates. The purchase price can be fair market value. It may be something less if the termination is for “cause” (i.e. violation of a non-disclosure agreement, etc.).

- Other Restrictions. The LLC can subject the service provider equity to other restrictions that may not apply to interests held by other owners, such as limits on access to certain financial information (like information on the ownership interests of other members); restrictions on the transfer of the interests; drag-alongs.

LLC Options

An LLC option is a contractual right held by the grantee to purchase a capital interest in the LLC at a fixed price in the future. Unlike corporations, LLCs cannot issue “incentive stock options.” There is no final guidance from the IRS on how compensatory nonqualified options of an LLC will be treated, however. For now, it is assumed that the tax treatment will be similar in many respects to a compensatory nonqualified stock option of a corporation; that is, so long as the option is granted with a strike price equal to fair market value at the time of grant and is exempt from, or complies with the requirements of, Section 409A of the Code, there is no income for the service provider and no deduction for the LLC upon grant.9

Upon exercise, the service provider will recognize ordinary income equal to the spread between the exercise price of the option and the fair market value of the LLC interest received and the LLC may have an equivalent deduction (which passes through to the existing members). Under present law, it is likely that upon exercise the LLC will be treated as a deemed taxable transfer of a proportionate share of LLC property to the service provider followed by a contribution of the deemed transferred property.10

LLC Equity Appreciation Rights or a Bonus Based on Equity Value

A service provider may be granted the contractual right to receive a share of the profits earned by (or appreciation of) an LLC. These arrangements are not actual equity and the service provider is not treated as a partner for tax purposes. Rather, they are deferred compensation arrangements that are subject to special rules under Section 409A of the Code.11 These rules restrict the timing of deferred compensation and impose harsh penalties for non-compliance.

Deferred compensation is ordinary income to the employee when received and, generally, deductible by the LLC when paid. For example, an LLC can structure a bonus arrangement through a management bonus plan which allocates a percentage of a defined pool to certain employees under certain conditions set forth in such plan; or through a change in control bonus plan where the bonus payment would only be paid in the event of a change in control of the limited liability company (or a sale of the company’s assets). A service provider who is granted an equity appreciation right or a bonus rather than equity can remain an employee (rather than a partner) for tax purposes.

Conclusion

When the objective is to issue a service provider real equity, rather than an unsecured contract to pay a bonus in an amount tied to the value of the company, the interest will have to be granted as a capital interest or profits interests. LLC options are available, but as described above, the tax treatment is uncertain and there is risk of unintended tax result. As between a capital interest and a profits interest, the question is largely one of economics and taxes. A capital interest has current value and a profits interest does not. This means that the service provider receiving the capital interest will generally have taxable compensation income upon grant (or later vesting, if an 83(b) election is not made). Frequently, a key employee would prefer to take a profits interest because it is not currently taxable and does not require payment of any cash purchase price to the company. A profits interest is generally viewed as comparable to a non-qualified stock option or a stock appreciation right, but with the potential for capital gains treatment on exit. A bonus plan can give the same economics to the key employee, but all payments will also be treated as ordinary income when paid.

See our LLC Equity Incentives for Service Providers table for more information.

Footnotes

1. The tax consequences of a grant of equity in an LLC that has elected to be taxed as a corporation is equivalent to the grant of equity in an entity formed and taxed as a corporation.

2. This example assumes the LLC (and the corporation) only have one class of equity outstanding with equal rights to liquidation proceeds.

3. A “restricted” interest is one that is “substantially non-vested.” An interest is “substantially non-vested” so long as it is both subject to a “substantial risk of forfeiture” and “non-transferrable.” Equity that may be repurchased by the issuing entity for a price that is less than fair market value if the grantee stops performing substantial services or fails to meet a condition related to the purpose of the transfer (such as the achievement of a performance target) is subject to a “substantial risk of forfeiture.” Equity is non-transferrable so long as it cannot the transferred free of a ”substantial risk of forfeiture.”

4. Capital interests, whether restricted or unrestricted, constitute “property” for purposes of Section 83(b) of the Code. Section 83 provides, in general, that when there is a transfer of property for services, the value of the property less the amount paid, if any, is taxable to the service provider upon grant or, if later, as the property vests. If a Section 83(b) election is made, the value of the property less the amount paid will be taxable to the service provider upon grant. A Section 83(b) election must be filed with the IRS within 30 days of grant of the property.

5. Proposed Treasury Regulations would treat the transfer as a deemed transfer of cash, not property. This approach would eliminate the gain, loss and deduction on a proportionate share of the LLC’s assets.

6. See Footnote 5.

7. A grantee may choose to make a Section 83(b) election if the capital interest was granted at a low value and she anticipates further appreciation or she may be required to make one by the LLC as a condition of the grant so she is treated as a tax partner from the outset.

8. Rev. Rul. 1993-27 C.B. 433

9. A discussion of Section 409A of the Code is beyond the scope of this article.

10. See Footnote 5.

11. See Footnote 9.